Evaluation of digital channels: app, web, and mobile web. Identification of observations and gaps to propose prioritized improvements based on their impact on customer experience.

BancoEstado, as the bank with the largest customer base in Chile, operates as a major software hub for a vast and diverse audience. According to CMF (1) figures, in January 2024, over 14 million customers (75.13% of Chileans) accessed their accounts on BancoEstado’s private site, and its public site received 235 million visits during the same period.

The project’s objective was to conduct an in-depth diagnosis of the web, mobile web, and app channels, aimed at identifying breakdowns and gaps in customer interactions with the Bank.

Based on the observations gathered, prioritized improvement recommendations were proposed according to their impact on customer experience and delivered to the Bank for implementation, with the goal of positively influencing satisfaction and recommendation indicators.

The project started with an immersion process that included gathering available secondary information (such as brand perception studies, usage indicators, quality surveys, among others) and meetings with stakeholders responsible for overseeing the customer experience in digital channels.

As a result of this process, we defined a work plan that segmented the evaluation of 16 functional groups into 5 delivery cycles.

These functional groups encompassed various functionalities within the same category. For example, in the case of electronic fund transfers, we evaluated transfers to third parties within the same bank, to other banks, between products, and recipient management, among others.

The plan included functionalities based on four criteria: frequency of use, criticality to the customer experience, strategic importance to the offering, and transversal elements (such as Information Architecture, Accessibility, and Performance). Reviewing these transversal elements was crucial, as it allowed us to identify observations in areas that do not always have a clear responsible party within organizations.

In each cycle, we sought to collect information across three dimensions:

The iterative nature of the cycles facilitated retrospective review sessions, enabling us to progressively refine the deliverables until we aligned on manageable observations and actionable recommendations for the Bank’s working teams.

This phase marked the point where the audit to identify observations impacting the customer experience was transformed into a deliverable in the form of a journey map.

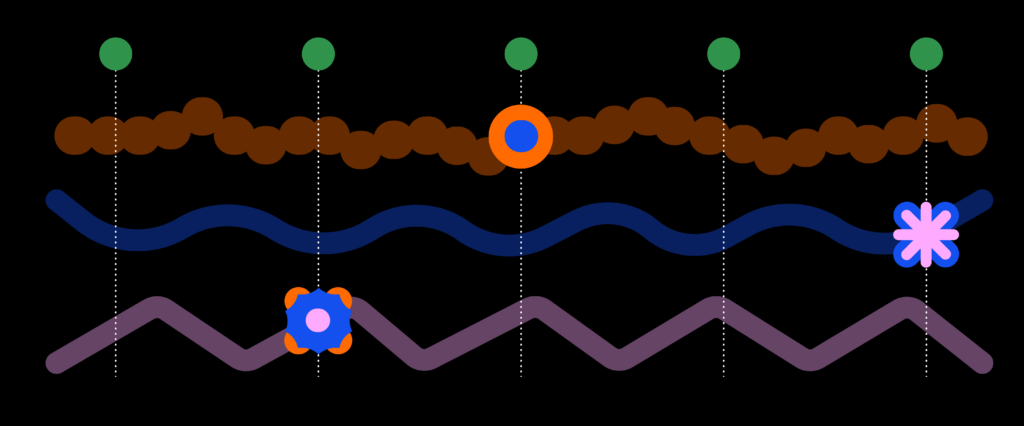

Upon completing the diagnostic and recommendation phase with the 16 functional groups, we collaboratively defined variables to systematize the generated knowledge. We organized the analyzed functionalities into 25 sequential moments across 6 stages of the journey, addressing discovery, acquisition, usage, and product management.

The axes for organizing the functionality mapping were:

To conclude, we conducted a presentation to a broader audience, focusing on the project, its methodological development, and results.

In the first part, we provided context to enhance the intelligibility of the deliverables for those who had not been consistently involved during the eight months of work.

We then specified the observations in seven focal points to organize the results into actionable lines of improvement.

Finally, we presented the project conclusions and opportunities for the organization, based on the insights gathered during the cycles and all other contact points affecting the digital customer experience.

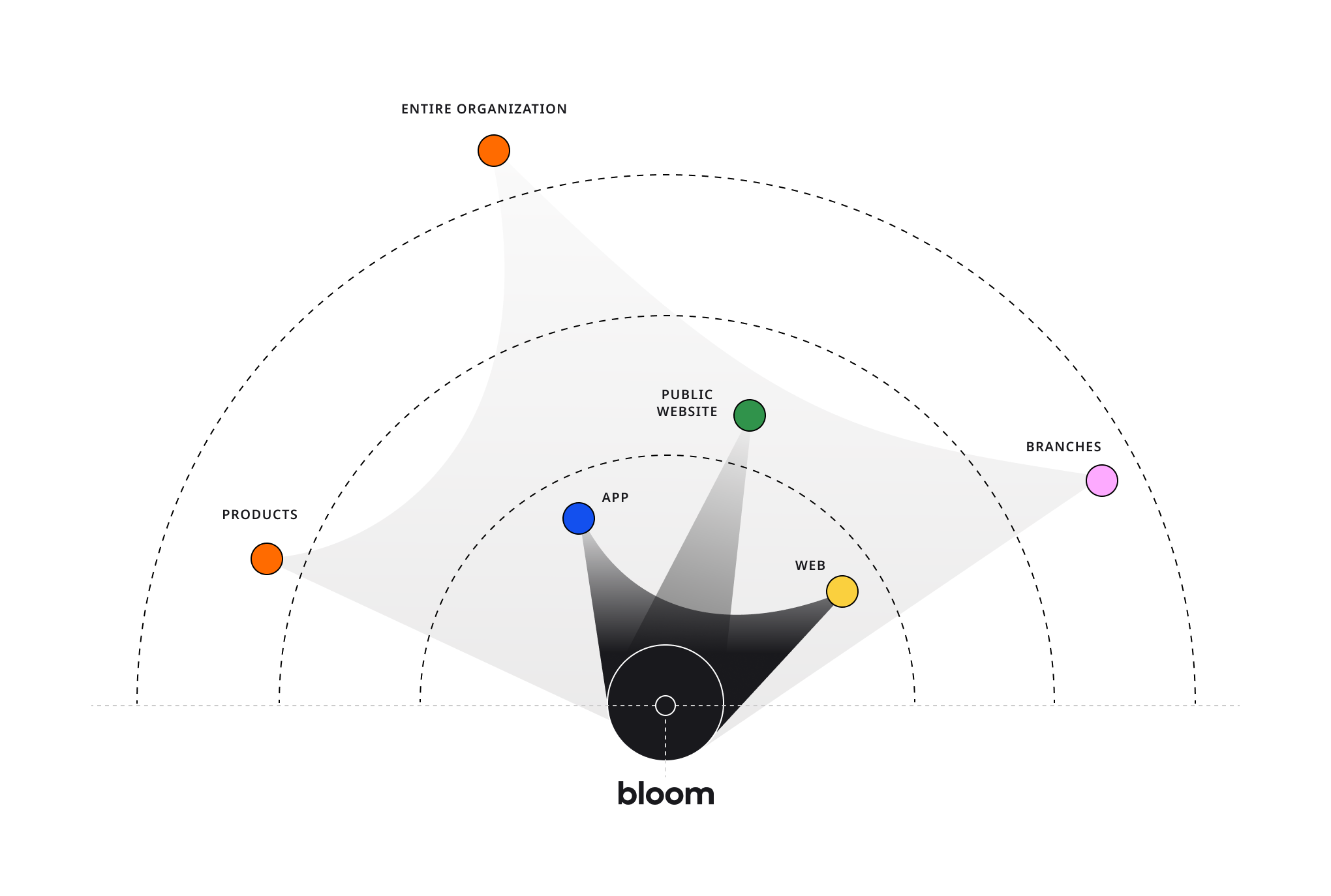

The following image schematizes bloom’s perspective in this consultancy. Although the main focus of the study was the customer experience on the bank’s app and website, the project revealed observations related to other subsystems within the organization, which also affect software delivery.